Hey, Ross here:

It’s the middle of the trading week – and a big day for the markets. Here’s what I got for you.

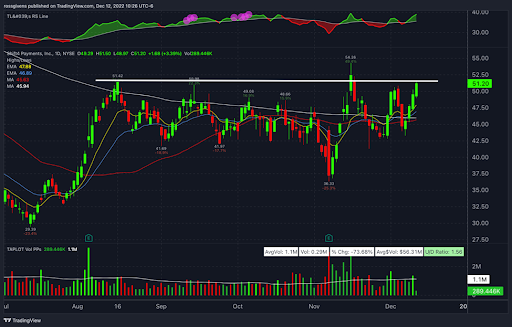

Chart of the Day

After falling over 70% during its Stage 4 downtrend in 2021 and early 2022, payments processor Shift4 Payments (FOUR) has finally found solid footing in the $40-$50 range.

As you can see, shares have been consolidating in Stage 1 – with the potential for a breakout in a new Stage 2 rally.

Volume looks good as well. We have seen almost a dozen high-volume up days over the last six weeks – a sign of potential accumulation by large institutions.

The 21, 50, and 200-day moving averages are also forming a support zone in the high to mid $40’s. If you buy this stock, this would be a logical place to place your stop.

Insight of the Day

Investors are getting tunnel vision over what the Fed will do “next” – and missing the bigger picture

The almost universal consensus is that the Fed will increase rates by 50 basis points tomorrow. After comforting inflation data, many investors seem to think this signals the Fed may actually begin to cut rates next year.

What most people are missing is that most economists are forecasting that the Fed’s terminal rate – the peak interest rate – is expected to stay above 5% until at least 2024. Expecting the Fed to “save” the stock market and trigger another 2020-esque rally is a fool’s hope.

But as I’ve shown time and time again in this very newsletter, you don’t have to wait for the entire market to rally to pocket healthy profits from stocks.

All you need is a system with an edge that exists no matter what the market is doing – such as by tracking where the big institutional money is flowing. Interested in finding out more about such a system? Click here to learn more.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily