Hey, Ross here:

The festive season is upon us – but the markets never sleep. Here’s your trading idea of the day.

Chart of the Day

KLA Corporation (KLAC) is one of several American semiconductor companies set to benefit from the CHIPS Act – designed to bring the production of microchips and semiconductors back to the United States.

The stock rallied 56% in a month off its October lows before finding resistance near the $400 mark. Shares stalled here in the past as well, so it is not surprising that KLAC is running into supply at this level.

Still, relative strength is surging to make new highs, and KLAC is consolidating nicely on low volume.

Watch for a breakout here – preferably on a daily surge in volume.

Insight of the Day

Don’t wait for the Fed to botch the landing.

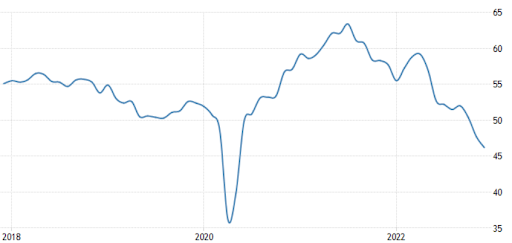

The S&P Global Purchasing Managers Index released Friday showed that US manufacturing is contracting at its fastest pace since May 2020 – adding to fears of a 2023 recession.

The chances of the Fed being able to hit their “soft landing” of the economy are shrinking by the day. They botched it up months ago by moving too slow on inflation – it’s too late to course correct now.

My advice? Don’t wait for the Fed to botch the landing – especially when you can already see it coming.

The good news is that it’s December, a time where trading volume is generally lower. This means even relatively small moves – especially those by the big institutional money – can have an outsized effect on stock prices.

And if you know where this money is moving, you could take advantage of it to capture gains that can help you weather the coming storm. Here’s exactly how to do that.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily