If you have a gambler’s mentality, you’ve likely made a few “bets” on company earnings.

After all, traders love earnings season. It’s when the biggest moves tend to happen.

If a company reports sales and earnings that beat expectations, the stock can gap dramatically higher.

The opposite is also true… If a company reports sales and earnings that miss expectations, the stock can gap dramatically lower.

This creates a situation where a trader can make or lose a lot of money in a very short period of time.

Personally, I don’t like guessing what a company’s earnings will be.

Why? The gaps!

What is a Gap?

A “gap” forms when a stock opens much higher or lower than it closed the previous day.

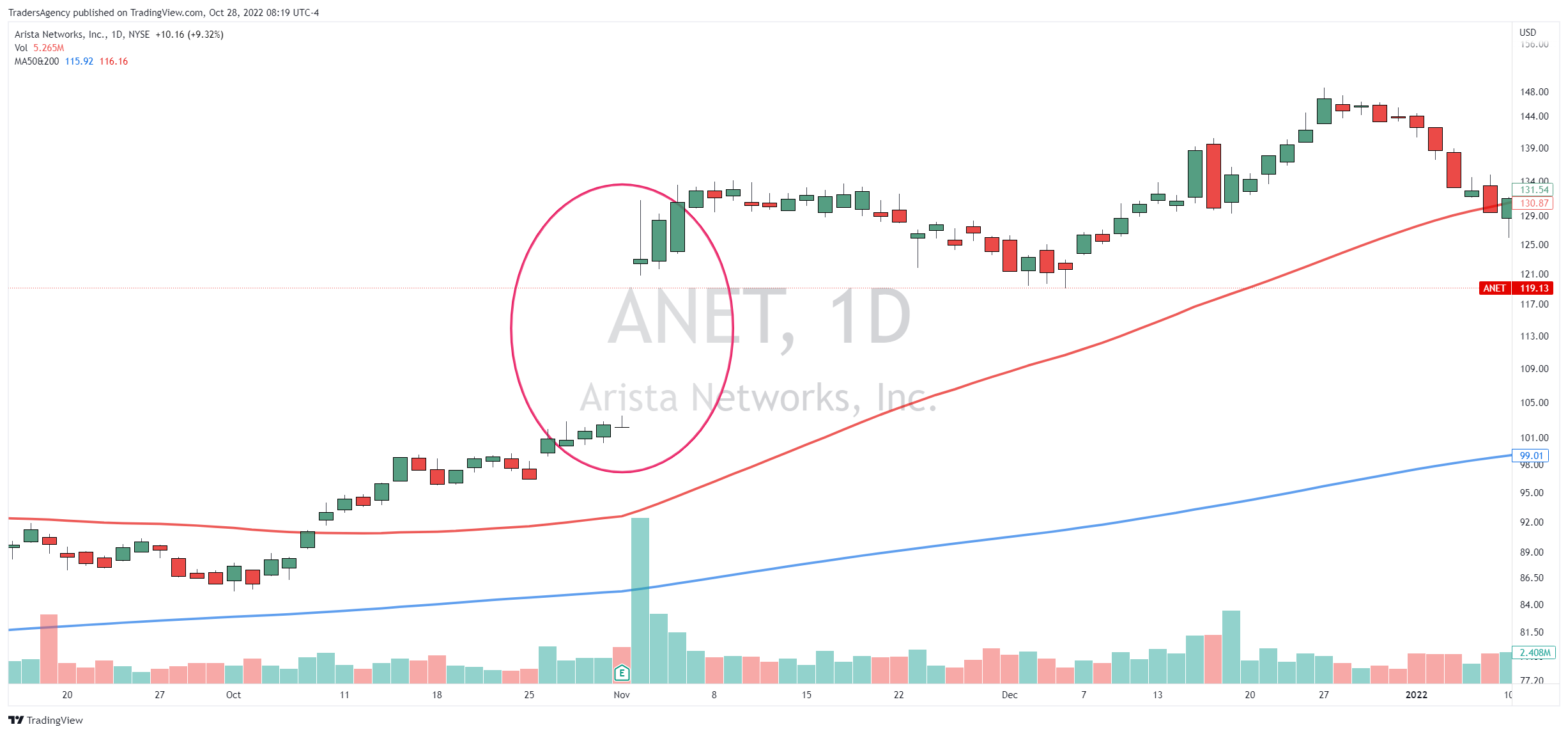

Here is an example of a gap in Arista Networks, Inc. (ANET) from a year ago when it reported strong earnings after the close.

The stock opened the day 20% higher than it closed the day before.

That’s a big gap!

And if you were on the wrong side of it, it stung pretty good.

So, it is important to have an idea of how far a stock could move following its quarterly earnings report.

How to Guess the Gap

Luckily, there’s a website for that: OptionSlam.com

OptionSlam determines the implied weekly move of a stock based on trades being placed in the options market.

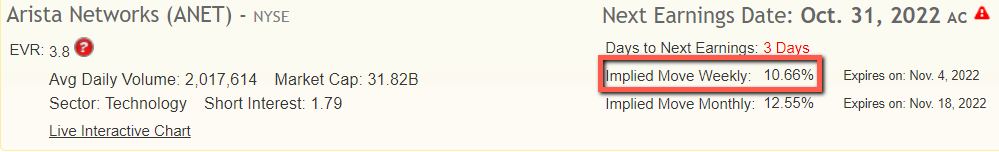

Let’s revisit Arista Networks since it is scheduled to report earnings on Monday, Oct. 31, after the close.

OptionSlam is forecasting a 10.66% move in ANET over the next week.

If the reaction to the report is bullish, that would mean a move up to just under $132 a share.

If the reaction to the report is bearish, ANET could fall to around $106.50.

It is important to remember that this is a prediction. It is not foolproof.

But the options markets are smart, and this will give you a pretty good idea of what to expect.

Preempting Earnings

I like to check the expected earnings move on stocks I already own.

If I only have a 5% open gain but the market is expecting a 20% move on the earnings report, I’m getting out.

It is not worth the risk of having the trade move against me by 20%.

On the other hand, if I am up 10% on the stock but the forecast is for a 5% earnings move, I will hold on.

Remember… I always think about risk first, and this is another way to keep risk to a minimum.

Join the Insiders

Now, if you’re interested in another way to minimize risk in the stock market, one way is to follow corporate insiders like CEOs, CFOs, executives and board members…

Corporate insiders are always buying or selling shares in the companies they operate… And they have a footing of knowledge that Main Street investors simply do not.

I’ll cover my strategy for trading alongside corporate insiders and generating potentially massive gains with minimal risk.

I look forward to seeing you there!

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily