Individual investors like us trade options for a wide variety of different reasons.

But for me, there is only one reason to buy options…

Limited risk! It is the biggest advantage they offer.

And in a market like this, that’s exactly what you might want.

Let me explain…

Option Rules to Profit

With options, you can risk much less money and get the same exposure to the market.

For example, if a stock is trading at $50 a share and you want to buy 100 shares, the cost of that investment is $5,000.

That’s also your risk.

It’s unlikely, but the stock could go to zero, and you would lose all $5,000.

Most people wouldn’t let that happen. Most people use a stop loss — a proverbial “uncle point” where they will get out of the trade.

Using the $50 stock example, maybe your max risk is 20%. You plan to sell if the stock goes below $40. So your risk would be $1,000 ($10/share x 100 shares).

Usually, unless it is an extremely volatile stock, you can get the same exposure with options for less money (and less risk).

A $50 call option that expires a few months from now should cost 2 or 3 bucks a share. Each option represents 100 shares, so the total investment would be around, say, $250.

Even if the stock goes to zero, you cannot lose any more than that $250.

So, if you think a big move is coming from an earnings report, FDA decision or other major news event, options are a way to limit your risk while giving you the same profit potential.

Just be sure to follow these three simple rules…

Option Rule #1

Only risk what you would on the stock…

In the $50 stock example earlier, the trader planned to risk $1,000 on the trade. They invested $5,000, but only wanted to risk $1,000.

Don’t make the mistake of buying $5,000 worth of options hoping for a home run if you cannot stomach losing the full $5,000.

Because, trust me, it is a real possibility.

You are also likely to bail early if you trade them too tight. Options are volatile. They need room to move.

Invest accordingly… You can control the same 100 shares of stock for a fraction of the cost by buying just one option contract.

Option Rule #2

Use limit orders…

Depending on how popular the stock is, options can be very thinly traded. Especially if it is an out-of-the-money strike price with an expiration a few months away.

A stock that sees a million shares traded every day may only see a few dozen contracts of a particular option trade hands over the same period.

Because of this, the spreads can be wide. For example, it is not uncommon to see a bid price of $0.50 and an ask of $0.90.

I usually place a buy limit order near the middle of the spread (70 cents in this case) and let it work.

If you want to be even more tactical, you may choose to bid even lower. Let the order work for an hour and see if you get filled. If not, you can always replace the order and enter a higher price.

Option Rule #3

Watch the implied volatility…

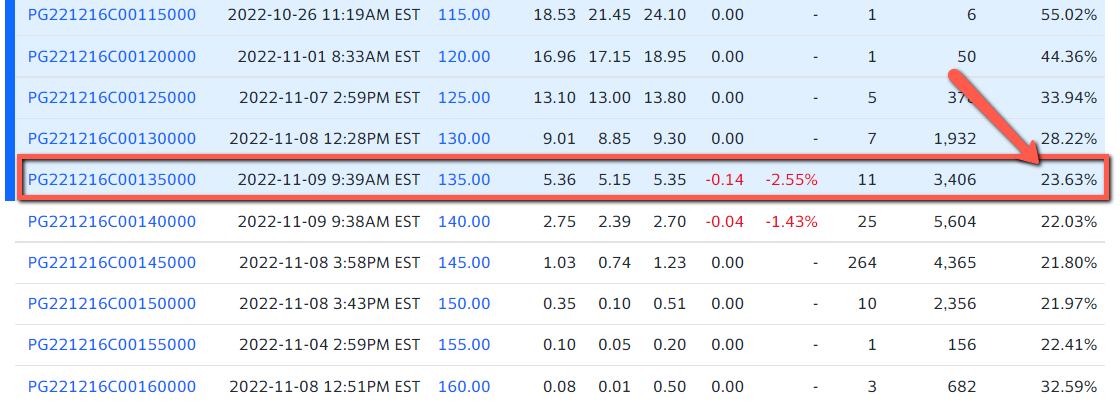

The implied volatility, or IV, is displayed next to each expiration month on an option chain. The higher the IV, the more expensive the options.

I like to see this number below 40 if I am buying options.

Stocks like MicroStrategy Incorporated (MSTR) and other volatile names can get much higher.

Right now, at-the-money December monthly options for MSTR have an IV of ~122%.

But at-the-money December monthly options for Procter & Gamble (PG), on the other hand, have an IV of ~24%.

When the IV is high, you will pay more for the option since the market expects a larger move from that stock. So even if the stock goes in your direction, you will lose money if it doesn’t move enough.

If an option has an extremely high IV, I won’t buy it.

My Latest Research Project

Options are great when you want to swing for the fences and hit big homeruns. But there’s another way to score market-beating returns…

Regular readers know I have years of experience following the stock trades of corporate insiders, and I’m now looking for even bigger gains by following the insiders in Washington DC.

We all know that those in power are making millions with their uncanny knack for buying into stocks ahead of massive moves.

It’s enough to make you think that the system is tilted against the individual investor.

But not to worry… There are legal ways to follow these transactions by DC insiders without ever being accused of insider trading…

My brand new Undercover Trader research service focuses on exactly that, and I’ve just put the finishing touches on my latest presentation.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily