“Don’t ever average losers. Decrease your trading volume when you are trading poorly; Increase your volume when you are trading well. Never trade in situations that you don’t have control.”

Paul Tudor Jones

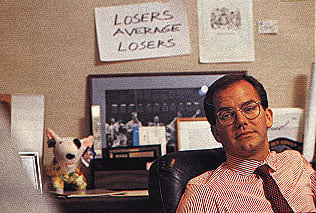

There is a famous picture of Paul Tudor Jones in his office. Behind him, a single sheet of paper is tacked on the wall with a simple phrase: LOSERS AVERAGE LOSERS.

Paul Tudor Jones is one of the greatest traders who ever lived.

In 1987, he predicted the Black Monday crash and tripled his money in a single day – earning an estimated $100 million.

His success has continued for more than three decades. Today, the hedge fund titan has a net worth of $5.3 billion. This image always struck me.

Here is this market legend… a billionaire trader… a certified Market Wizard… and even he has to remind himself of this simple truth – Losers Average Losers.

Another legendary market maven, Jesse Livermore warned against averaging down on losing trades 100 years ago.

“Of all the speculative blunders there are few greater than trying to average a losing game. Always sell what shows you a loss and keep what shows you a profit.”

Jess Livermore

You buy a stock at $50.

A week later it’s trading at $40.

If you liked it at 50, you should love it at 40, right?

Wrong.

This is a fatal flaw. And one we are all guilty of. The market is always right. Price is all that matters. Regardless of our perception of a stock’s value, it is only worth what someone else is willing to pay for it. Averaging down is the quickest route to the poor house. This is how day trades turn into swing trades and swing trades turn into long-term positions. We get attached to a stock. Our ego doesn’t want to accept the loss. “I’ll get out as soon as I’m back to break-even,” we say.

But it doesn’t come back.

It falls lower.

Throwing good money after bad in order to lower your cost basis does little more than turn a small loss into a big one. Sure, the market will bail you out on occasion. But it only takes one big loss to destroy months or years of good trading. Your friend buys XYZ stock at $100 a share. A few months later, it’s down by half trading at $50 a share. You buy at a “discount” thinking you’ll double your money when the price bounces back. A year later, it has fallen to $10.

Your friend is down 90%. You’re down 80%. You bought at $50 – HALF the price he paid – yet your loss is only 10% less. We call these bear traps – stocks that look cheap based on where they traded in the past.

But stocks going down are doing so for a reason.

Maybe sales and profits are on the way down. Maybe the company lost a major contract. Maybe their product has fallen out of favor.

Remember BlackBerry (BB)?

There are still traders holding shares of this dumpster fire hoping the company makes a turnaround.

Don’t be afraid to take a loss.

You can’t win if you are not willing to lose.

Finding More Stocks Ready to Surge

You need to keep an eye on my weekly release of my three stock watchlist that I post each and every Monday. And for more on them click here: (TKTK).

And to get a handle on how I find the right stocks that are set to surge, you need to read my special report free for subscribers to my Stock Surge Daily: The Magic of the SSI Indicator. To download and read it for free, click here: (TKTK).

P.S. Congrats to those who took my advice on ADTRAN (ADTN). The stock broke out Monday and is up 8.7% from June 3 to now.

ADTRAN Total Return Source Bloomberg

The Alabama-based company makes must-have equipment that empowers older telecom transmission lines to move more data quicker and with better security. And with the biggies in the telecom markets as good customers, including AT&T (T) and Verizon (VZ) – the company is now getting more notice in the market with its stock.